The Council of Ministers approved, in its session of this Tuesday, December 27, a Royal Decree-Law of measures in response to the economic and social consequences of the international situation and other situations of "vulnerability", such as the rise in inflation. One of the main measures has to do with the reduction of food prices. According to official information published by Moncloa:

"The VAT on fresh products that already had a reduced rate is abolished and the VAT on oil and pasta is reduced from 10% to 5%, which will reduce the price of basic and staple foods such as bread, milk and fruit and vegetables, in addition to those mentioned above. In this way, it is intended to alleviate the situation of families, more intensely for low-income families who devote a greater part of their income to these goods. This tax cut will be maintained until June 30 or until underlying inflation falls below 5.5%".

This change in the VAT rates on food has a direct impact on the hospitality industry, so from the moment the Royal Decree was approved, Gstock got down to work to facilitate the adaptation to our customers and users so that they can have their business under control in this aspect as well, with the necessary changes already introduced.

The Gstock IT team has worked against the clock, a real spectacular sprint to have the tool completely adapted in 24 hours and to facilitate the management of our users, also in this aspect.

In this article we inform you about the keys to the provisional modification of VAT rates on food and how it affects the hotel and catering industry. And also, it is a guide for action if you are a user - administrator of Gstock on these changes announced by the Government on December 27th.

Modification of VAT on food: What are the changes?

The amendments approved in the Royal Decree entail a change in VAT on the following food categories:

ALL staple foods go from 4% to 0%, i.e., this 4% rate for staple foods is ELIMINATED.

- Legumes.

- Potatoes and tubers.

- Milk.

- Cheese.

- Eggs.

- Vegetables and fruits.

- Cereals.

- Bread and bread flours.

Oils (olive, sunflower...) and pasta are reduced from 10% to 5% VAT.

Modification of VAT on foodstuffs: How does it affect the hotel and catering industry?

When does it become effective and how long will it last?

The government has announced the exceptional nature of this measure to temporarily help control inflation.

- Start date: January 1, 2023.

- Termination date: June 30, 2023 or when inflation drops below 5.5%.

Modification of VAT on food: How does this change affect the use of Gstock?

Gstock is an ERP for stock control (in units) and raw material cost (in euros excluding VAT), so tax is NOT a critical parameter in either of these two conceptions of use.

Why doesn't it affect? Because stock control is carried out taking into account the units of product (purchased, transferred, wasted or sold) and, for cost control, these are always carried out with calculations using the taxable base (without VAT). This means that the cost calculation of shrinkage, inventories, recipes, transfers and other KPI's are always done without VAT.

That said, it is normal that as a Gstock user you want to have, in addition, control over the taxes levied on your purchases, and therefore worry about having the system well configured in order to be able to compare the purchase figures.

I am a Gstock user: In which cases should I reconfigure taxes in the tool?

- Customers who export packing slips and purchase invoices to accounting ERP's or other ERP's DO have to reconfigure taxes.

- Gstock users who export, either via integration or through excel exports, both delivery notes and purchase invoices to third party applications DO have to reconfigure and adapt Gstock to these changes.

When should I make the changes?

These changes must be made BEFORE the start of operations in 2023. If they are made in January, the following point about orders in the pipeline must be taken into account.

What will happen to the orders to be received and delivery notes to be validated in process BEFORE making the VAT changes?

Delivery notes to be validated and orders sent to the supplier BEFORE making the VAT changes and received AFTER making the VAT changes will have, by default, the old VAT at the time they are received and converted into a delivery note.

The solution is that they are received from the WEB application (not from the mobile application) since from the WEB application the VAT rates can be edited and they can be well received.

As soon as the VAT changes have been made in the Gstock configuration, the orders shipped and the new delivery notes will already have this VAT data updated.

What changes should I make in Gstock?

- For products changing from 4% to 0%: EDIT and MODIFY the VAT rate from 4% to 0% (instructions below).

- For products changing from 10% to 5%: CREATE a new VAT rate: 5% (vat at 5%). Only in case it does not exist from before (instructions below).

1. Instructions for products whose VAT is changed from 4% to 0%.

It is important to note that the change in VAT from 4% to 0% affects ALL foods with 4%, so in Gstock we have designed a "massive" change.

We have had to develop a new functionality to allow a change in the percentage of an existing VAT rate to be modified and applied in the same event. Thus, we have made changes so that Gstock "asks" the user if he/she wants the change in tax to be automatically registered in the entire product catalog/purchase supplier-formats and also in the sales product catalog (for licenses with central warehouse management).

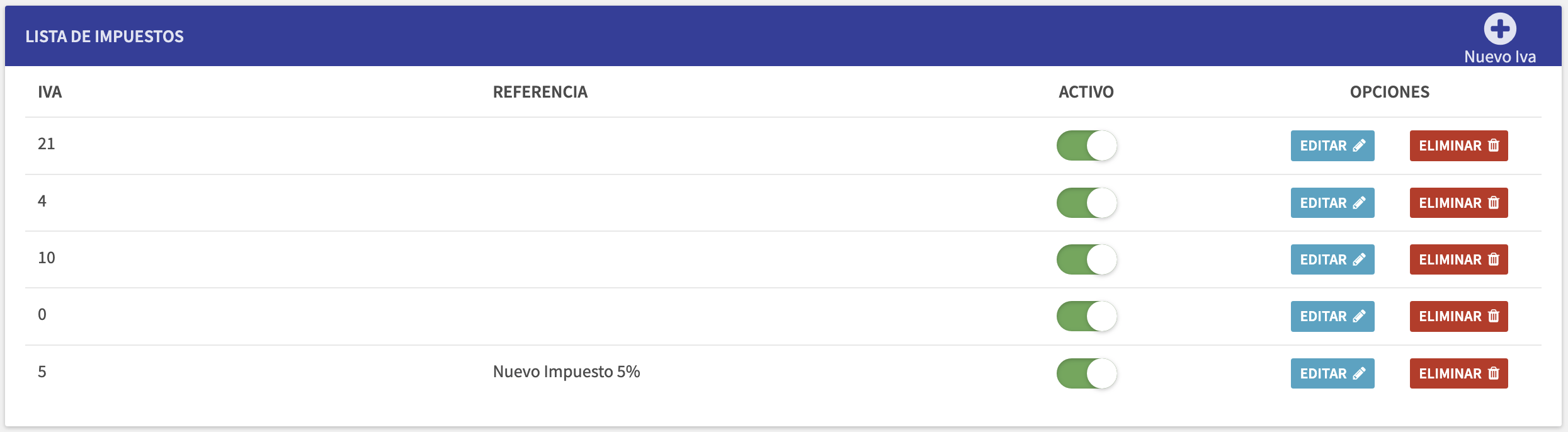

This new functionality, available from 12/30/2022 as of 3pm, will change the VAT on ALL the catalog that has the previous VAT in use. That is, in our case it will change the IBA from 4% to 0% on all purchase formats that use it.

Step-by-step modification

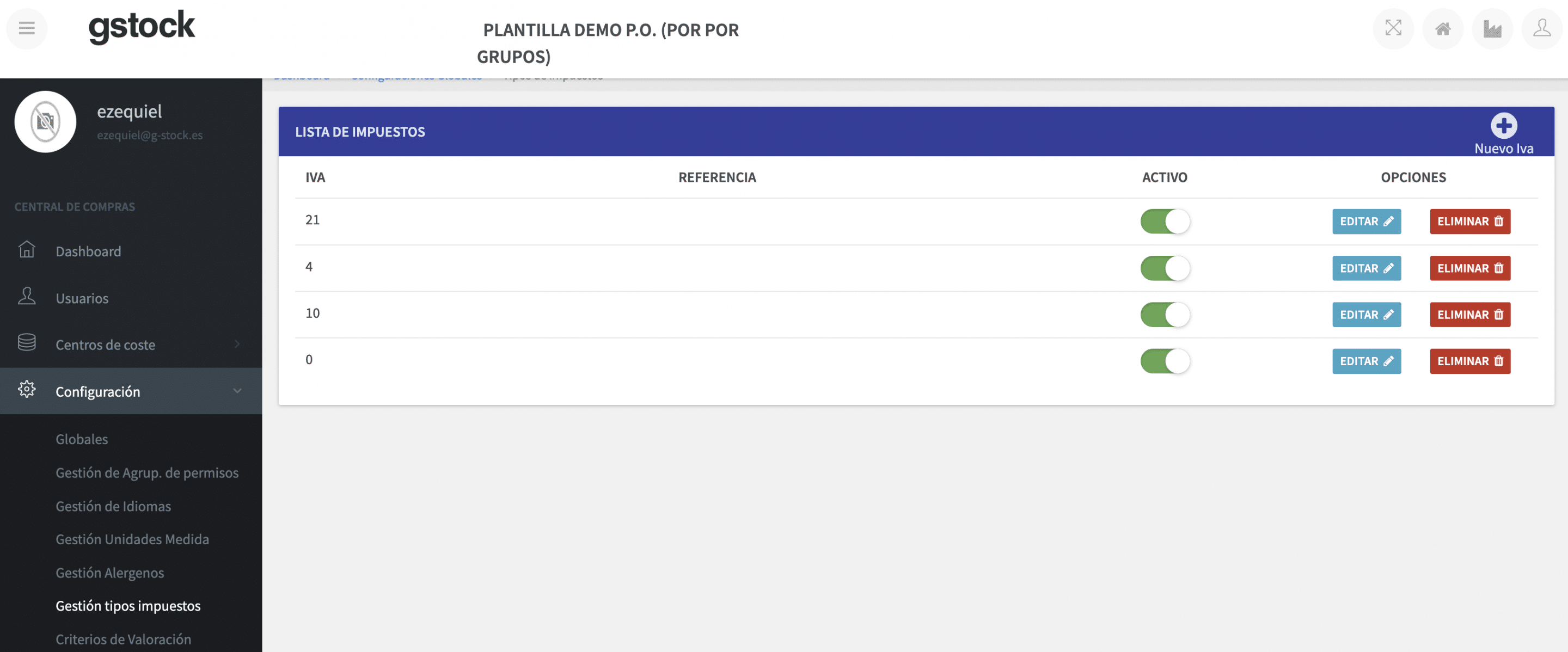

- This change must be executed by a user with sufficient permissions to make these changes (see https://gstock.atlassian.net/l/cp/f1kGdhuz).

- Once in tax configuration, we will check if a 0% tax rate already exists, if it does, WE DELETE IT.

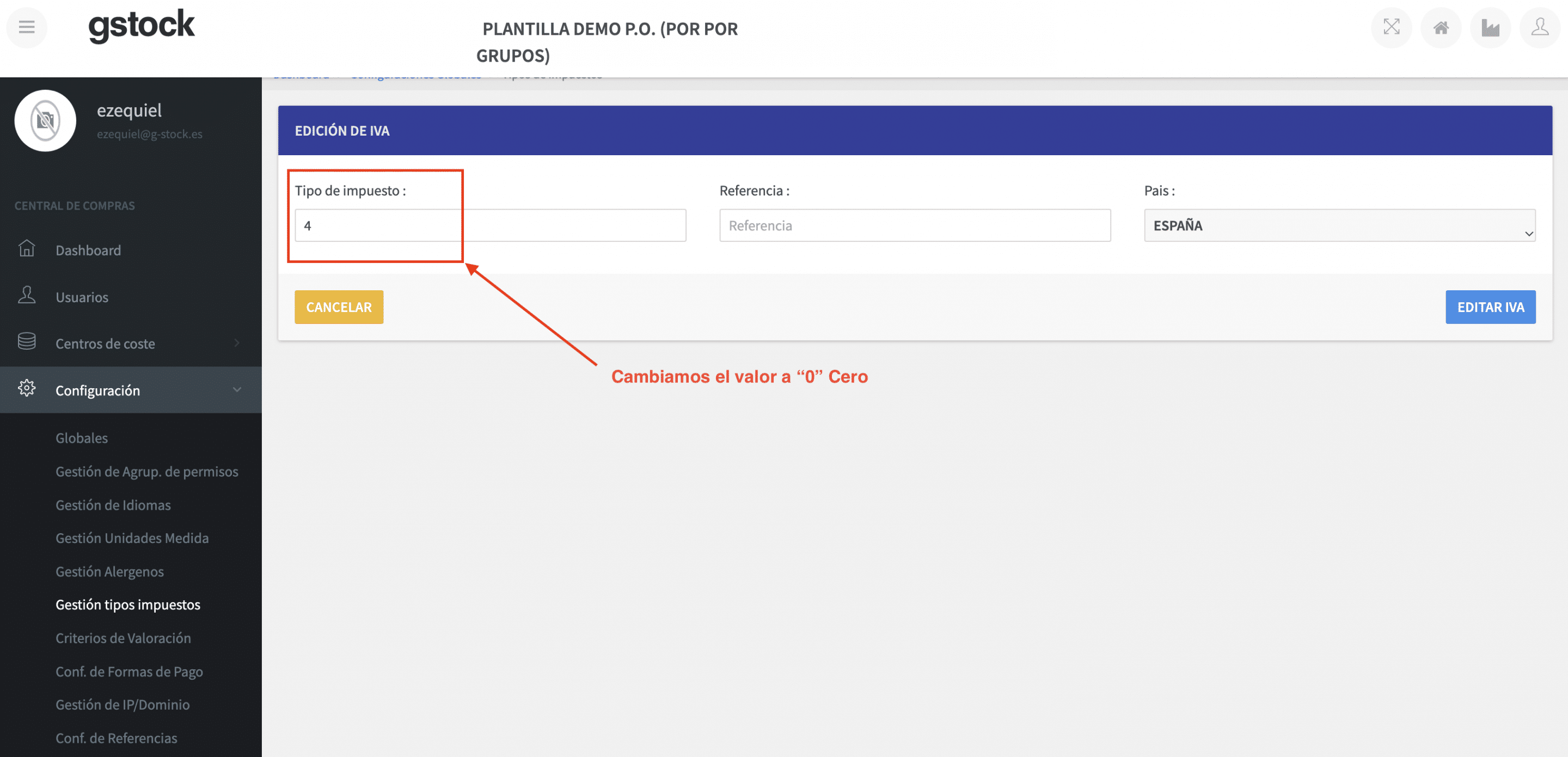

- Next, we go to the 4% tax rate, edit it and change it to 0%.

We recommend to put any reference that allows us to know which VAT is the one we have modified. In our case we have put "ref4".

-

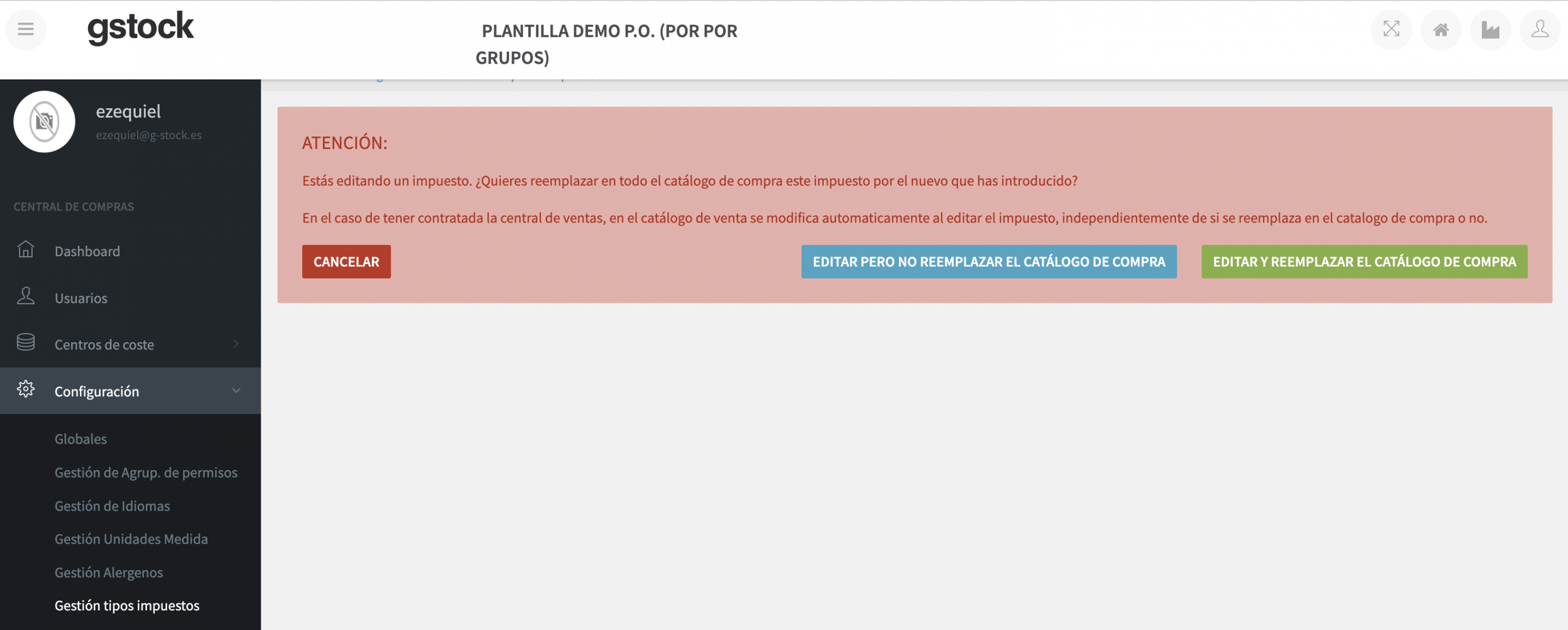

Gstock will then display a warning and option window:

- We will accept "Edit and replace the purchase catalog".

- With this acceptance, all VAT rates will be changed from 4% to 0%.

- Finally, in order to keep the old delivery notes with an existing tax, we will have to add a 4% tax (see https://gstock.atlassian.net/l/cp/f1kGdhuz).

At the end of the exceptional period of 0% VAT, we will have to do the reverse operation and restore the VAT rate to 4%.

2. Instructions for products whose VAT changes from 10% to 5%.

This change affects products in the Oils and pastes categories.

Step-by-step modification

- This selection of products will be much smaller than the previous one, but as the change does not affect ALL products with 10%, but only a few (pastes and oils), we have to do it massively but by hand or with export/import of products.

- This change must be executed by a user with sufficient permissions to make these changes (see https://gstock.atlassian.net/l/cp/f1kGdhuz).

- Once in tax configuration, we will check if a 5% tax rate already exists, if it does not exist, WE CREATE IT.

Once we have the new tax created, we have to change the VAT from 10% to 5% on these products. There are two ways to do this:

- Enter in each of the products and in each format modify the VAT in each supplier.

- Make a catalog export in Excel, in column L "TAX" replace the value "10" by "5".

After exporting we have to select the rows we want to modify. Although it is possible to modify only the rows of the affected products and not touch the others, we recommend uploading a file only with the affected products, to avoid possible unwanted modifications.

- After modifying column L, we save changes to the sheet.

- From the same product area, we import the same Excel.

The management and modification of products by means of a spreadsheet is an action for advanced users. Ignorance or mistakes when manipulating the spreadsheet could cause serious errors beyond repair after uploading the spreadsheet to Gstock.

For this reason, we always recommend saving an original download of the catalog in Excel prior to changes, which will serve as a backup in case of unwanted problems and can restore the catalog to its original state.